[full_width class=”shadowbox”]

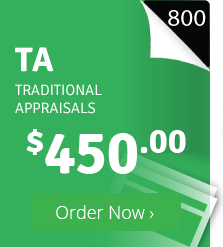

Traditional Appraisal

Fannie Mae / Freddie Mac standardized forms are the most widely used type of appraisal reports for residential properties. ValuTech’s GSE form appraisals are developed by the most competent appraiser in the property’s market utilizing our innovative technology-assisted valuation process to produce comprehensive appraisals with quantitative and qualitative support. For clients who want accurate, regulatory compliant appraisals for mortgage origination and loan underwriting.

[/full_width]

[full_width class=”shadowbox_nopadding”]

Compliant

conforms to USPAP and the Interagency Appraisal and Evaluation Guidelines.

Comprehensive

the most widely accepted appraisal format contains detailed information to support credit decisions in compliance with safe and sound lending practices.

Accurate

credible values, developed by professional appraisers employing the Sales Comparison Approach via ValuTech’s proprietary technology-assisted valuation process.

Credible

contains multiple approaches to value, property-specific data, property & comparable data and photos, neighborhood description, local market conditions and detailed analytics.

Timely

powered by ValuTech’s propriety database and market indexes providing current comparables and real-time market conditions.

[/full_width]

[clear]

Professionally Developed Opinions of Value on Industry Standard Forms

GSE Form appraisals have long been the valuation standard in the real estate industry; completed on standardized forms which are the most widely used format for residential properties. These reports are developed by licensed appraisers in compliance with USPAP and all applicable regulations and lending guidelines.

ValuTech’s innovative valuation process eliminates inefficiencies in the traditional one-off appraisal process and accelerates the analytic process to provide accurate, appraisals produced by the most qualified appraiser in the property’s market. Leveraging our proprietary technology-assisted valuation platform, our appraisals contain objective and quantifiable support. Our process is a whole new approach to valuing real estate and ensures compliance with all regulations especially quality, competency, appraiser independence and compensation.

These appraisal reports are completed on single family homes, condominiums and multi-family residential properties with either an interior or exterior inspection; and are the standard format for mortgages funded by a Federally Regulated Institution or their affiliates.

Applications

- Used by Regulated Institutions for first trust deed, loan origination

- Used to fund Home Equity lines of credits or second mortgages

- Asset disposition / REO

- Quality Control

- PMI Removal

[div class=”custom-tab”]

[tabgroup]

[/tabgroup]

[/div]